Crypto exchanges are the lifeblood of the digital asset ecosystem, serving as hubs for trading, liquidity, and innovation. In 2025, major announcements from leading exchanges continue to shape market sentiment, introduce new features, and influence how investors interact with cryptocurrencies.

From platform upgrades and new token listings to regulatory compliance initiatives and partnerships, these exchange developments often trigger significant market moves and impact investor confidence.

In this comprehensive article, we cover the most important recent announcements from top crypto exchanges, analyze their implications, and explain what traders and investors should watch closely. Whether you’re a seasoned trader or a crypto enthusiast, staying updated on exchange news is vital to making informed decisions.

1. New Listings and Delistings: Expanding and Streamlining Portfolios

1.1 High-Profile Token Listings

Exchanges have been actively adding promising tokens to their platforms in 2025, reflecting the growth of DeFi, NFTs, and layer-2 solutions. For example, Binance recently announced the listing of several high-demand tokens like zkSync Era (ZKS) and Aptos (APT), expanding access to fast, scalable blockchains.

Coinbase also added support for StarkNet (STARK) and ImmutableX (IMX), focusing on Ethereum layer-2 and NFT gaming ecosystems.

These listings often generate rapid trading volume surges and price appreciation due to increased accessibility.

1.2 Strategic Delistings for Compliance and Risk Management

To comply with evolving regulations and manage risks, exchanges have delisted some tokens deemed too risky or unregulated. For example, Kraken recently removed several privacy coins and tokens under SEC scrutiny, enhancing platform compliance and protecting investors.

While delistings can cause short-term price drops for affected tokens, they often bolster exchange reputations and long-term market stability.

2. Security Enhancements: Strengthening User Protection

2.1 Multi-Factor Authentication and Biometric Logins

Leading exchanges like Binance and Kraken rolled out new security protocols, including biometric authentication (facial recognition, fingerprint scans) and hardware security keys. These additions aim to reduce account breaches and phishing attacks.

2.2 Advanced Withdrawal Whitelists and Time Locks

Withdrawal whitelists limit sending funds only to pre-approved addresses, reducing hacking risks. Time locks add delays to withdrawal requests, allowing users to cancel unauthorized transactions.

These features are becoming standard and greatly increase user fund safety.

3. New Trading Features and Products

3.1 Introduction of Perpetual Futures and Options on New Assets

Exchanges have expanded derivatives offerings, introducing perpetual futures and options on altcoins like Solana (SOL), Polkadot (DOT), and Avalanche (AVAX). This broadens hedging and speculative tools for advanced traders.

3.2 Launch of Spot-ETF Trading Pairs

Some exchanges now offer spot-ETF pairs, allowing investors to trade ETFs pegged to crypto indexes directly on the platform, merging traditional finance with crypto trading.

3.3 Enhanced Mobile App Trading and Social Features

User experience improvements include social trading tools where users can follow and copy trades from top investors, increasing engagement and education.

4. Regulatory and Compliance Updates

4.1 Licensing in New Jurisdictions

To expand legal operations, exchanges like Coinbase and Kraken have secured licenses in countries such as the UAE, Singapore, and Germany. These moves improve access to regulated markets and enhance trust.

4.2 Enhanced KYC/AML Procedures

New rules mandate more robust Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. Exchanges now require video verification and proof of source of funds, balancing regulatory compliance with user onboarding efficiency.

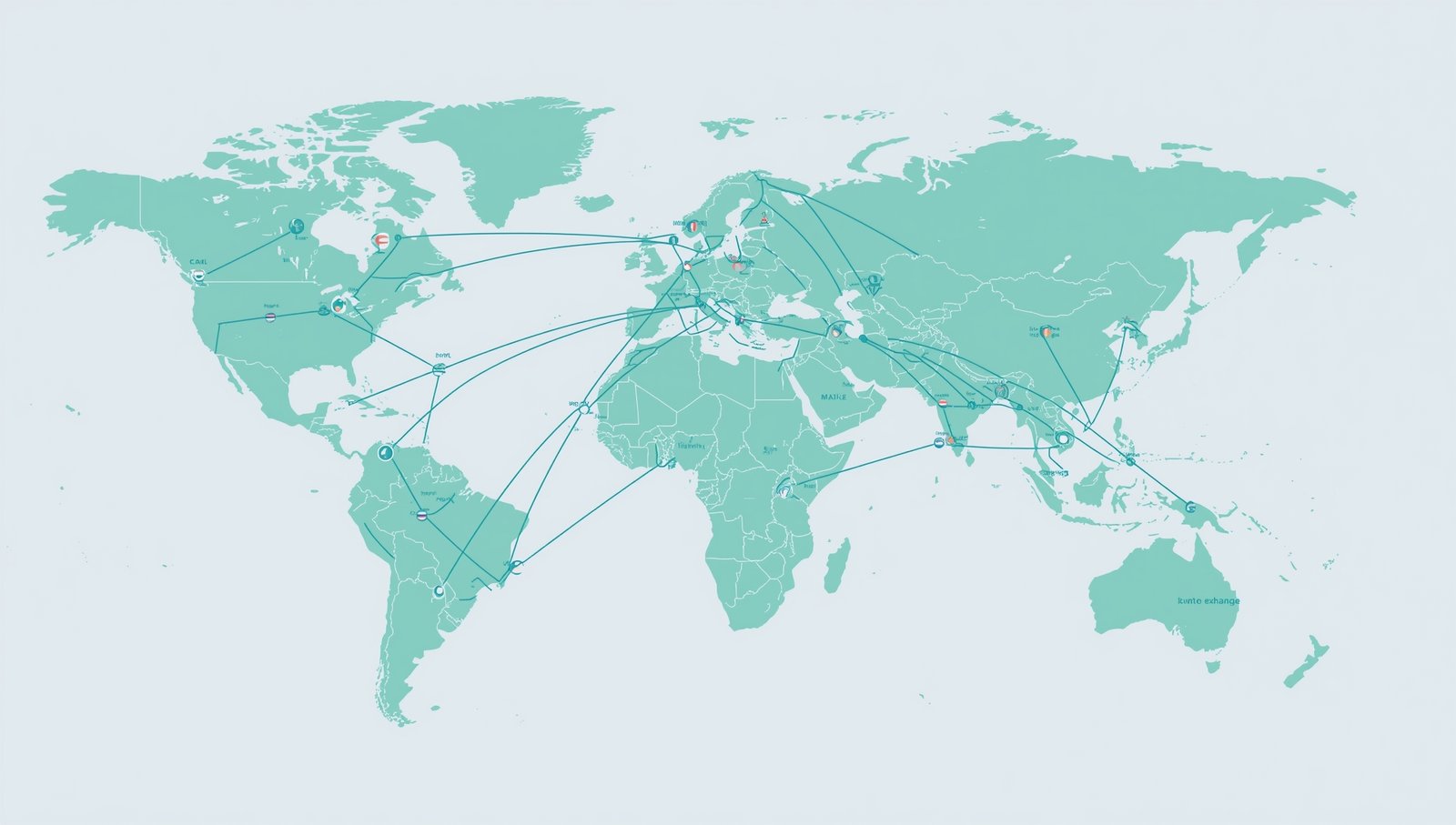

5. Partnerships and Ecosystem Integrations

5.1 Collaborations with Payment Processors and Banks

Exchanges have partnered with Visa, Mastercard, and fintech firms to enable seamless crypto-to-fiat transactions, including crypto debit cards and instant settlements.

5.2 Integration with DeFi Protocols

To bridge centralized and decentralized finance, some exchanges offer one-click access to DeFi yield farming and staking through their platforms, simplifying user experience.

6. User Incentives and Loyalty Programs

6.1 Trading Fee Discounts and Rebates

Exchanges offer tiered fee discounts based on trading volume or native token holdings, incentivizing active traders.

6.2 Airdrops and Reward Programs

Many platforms reward users with airdrops for participating in staking, referrals, or holding specific tokens, encouraging ecosystem growth.

7. Market Impact: How Exchange Announcements Affect Prices

7.1 Listing Effect

New token listings usually trigger price spikes, often followed by increased volatility as new buyers enter the market.

7.2 Regulatory Compliance Announcements

Announcements about delistings or enhanced compliance can cause short-term sell-offs but often result in greater market confidence.

7.3 Security Upgrade News

Security improvements boost user trust and may attract institutional investors wary of risks.

8. What Investors Should Watch Next

- Upcoming token listings and partnerships.

- Changes in regulatory environments affecting exchange operations.

- User experience improvements that drive adoption.

- New financial products that expand trading and investment options.

Crypto exchange announcements in 2025 remain pivotal market movers, influencing liquidity, asset availability, user security, and regulatory compliance. Staying informed about these updates allows investors and traders to anticipate market trends, manage risks, and seize new opportunities.

Whether through token listings, security upgrades, or strategic partnerships, exchanges continue innovating to support a growing and diversifying crypto ecosystem. For anyone serious about digital assets, closely monitoring exchange news is an indispensable part of success.