Is Ethereum Facing Decline? Bitcoin Aims for $100K as ETH Struggles to Keep Up

Ethereum (ETH) Struggles as Bitcoin Eyes $100K, Losing Support After Three Years

Ethereum (ETH) has recently lost its long-standing support level against Bitcoin (BTC), a critical benchmark that held steady for over three years. On Friday, November 22, ETH dropped to 0.03187 BTC as Bitcoin surged toward its ambitious $100,000 price target. Meanwhile, Ethereum has faced significant resistance at the $3,500 level for nearly four months, with competitors, including Bitcoin, hitting new record highs this cycle.

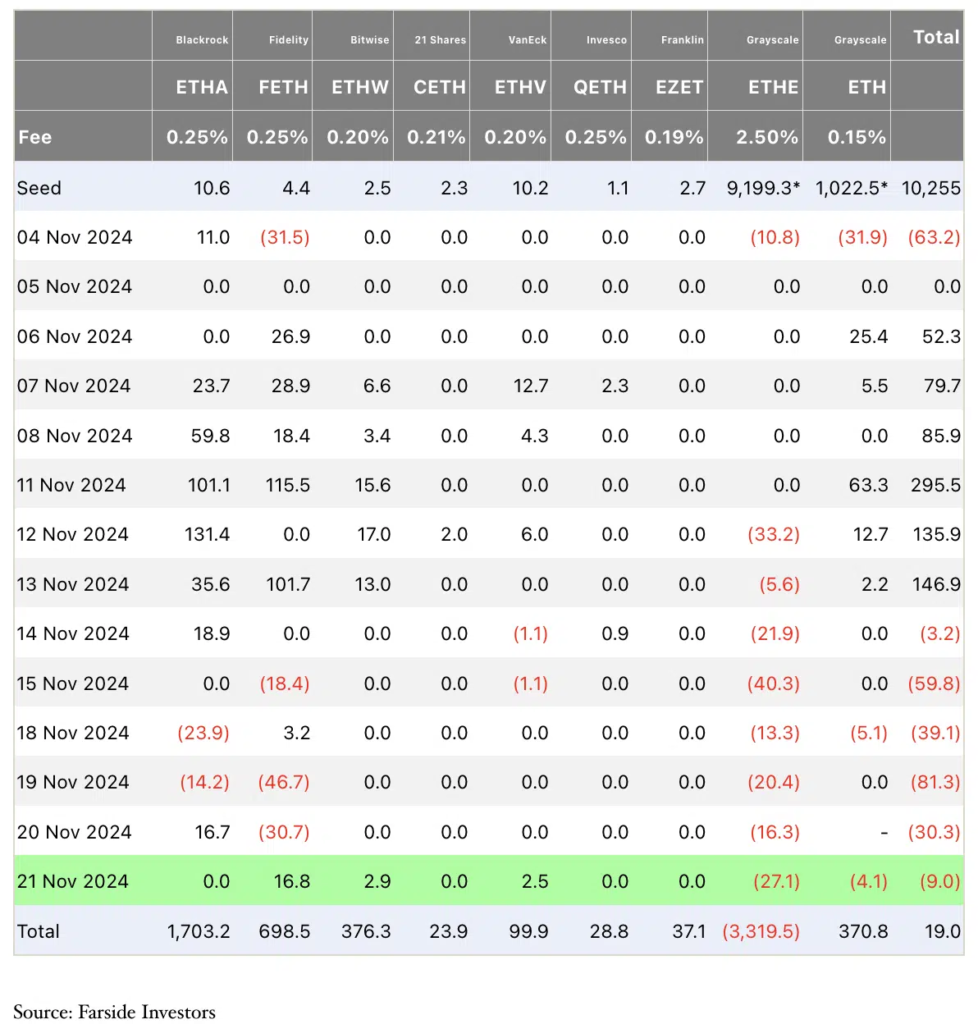

The Decline of Ethereum: Lack of Institutional Support and Weak ETF Performance

Ethereum’s struggle is becoming more pronounced as it loses favor with both institutional and retail investors. One of the major factors contributing to this decline is the diminishing institutional interest in Ethereum, which has become evident in the lackluster performance of Ethereum-based Exchange-Traded Funds (ETFs). In stark contrast, Bitcoin’s Spot ETFs have continued to outperform, drawing billions of dollars in institutional funds.

Recent data from Farside Investors UK highlights a troubling trend for Ethereum: ETH ETFs have experienced consistent net outflows for the past six days. This decline in institutional interest has been exacerbated by the growing shift of attention and capital toward Layer 2 and Layer 3 solutions, as well as other emerging blockchain projects, leaving Ethereum struggling to maintain its relevance in a rapidly evolving market.

The combined effects of these factors – from weak investor sentiment to a challenging market environment – suggest that Ethereum may be facing a prolonged period of underperformance, especially as Bitcoin continues to break records and gain market dominance.

Ethereum Faces Decline as Solana Challenges Its Dominance and Institutional Adoption Slows

Tuur Demeester, Editor-in-Chief of Adamant Research, recently told Forbes that Ethereum (ETH) might be “dying a slow death,” signaling a shift in market dynamics and the ongoing slowdown in institutional adoption of the Ethereum network. With Ethereum’s performance faltering and the growing appeal of newer blockchain projects, Ethereum faces increasing competition and pressure from both institutional and retail investors.

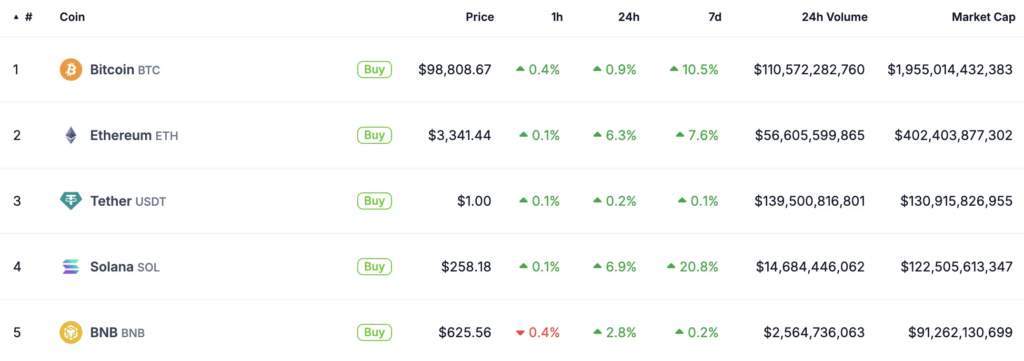

Solana (SOL) Challenges Ethereum’s Market Leadership

As Ethereum struggles to maintain its relevance, one of the most notable challengers to its dominance is Solana (SOL). Solana has experienced a significant market capitalization gain and a surge in price, propelling it into the top four cryptocurrencies by market value, according to CoinGecko. The rise of Solana represents not only a challenge to Ethereum’s blockchain supremacy but also highlights a broader trend of investors seeking faster, more scalable alternatives to Ethereum, particularly in the decentralized finance (DeFi) and smart contract spaces.

Ethereum’s ongoing difficulties, including weak ETF performance and waning interest from institutional players, are compounded by Solana’s aggressive market position. While Ethereum’s network remains dominant in terms of developer activity and dApp (decentralized application) usage, Solana’s ability to provide faster transaction speeds and lower fees is proving to be an attractive alternative. As the rivalry between these two blockchain giants intensifies, Ethereum’s future in the face of growing competition and shifting market conditions remains uncertain.

Solana Outperforms Ethereum in Transaction Volume and Protocol Fees Amid Ethereum’s Struggles to Break Key Resistance

In October and November 2024, Solana (SOL) has continued to outperform Ethereum (ETH) in critical blockchain performance metrics, including transaction volume across decentralized exchange (DEX) platforms, DEX activity, and the protocol fees generated. Solana’s dominance in these areas further solidifies its position as a leading blockchain network in decentralized finance (DeFi), showcasing its growing appeal among investors and developers.

Ethereum Faces Resistance at $3,500, Struggling to Sustain Bullish Momentum

While Ethereum has experienced a price climb on Thursday and Friday this week, it continues to face significant resistance at the $3,500 mark. A failure to breach this crucial level of resistance could hinder Ethereum’s chances for sustained upward movement and could dampen prospects for further gains in the near term.

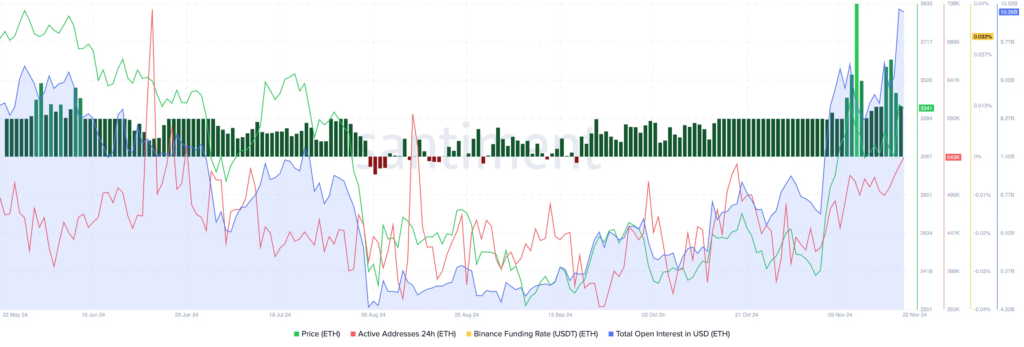

On-Chain Metrics Offer Mixed Signals for Ethereum’s Prospects

On-chain metrics for Ethereum are currently inconclusive. Active addresses on the Ethereum network have remained well below the levels seen in mid-August 2024, signaling a potential slowdown in user activity. However, the funding rate on Binance has remained consistently positive since mid-September 2024, suggesting continued investor confidence.

Ethereum’s Futures Market Shows Growing Demand

Despite the mixed on-chain signals, Ethereum’s futures market has shown significant growth. Open interest in Ethereum futures, a key metric for assessing demand among derivatives traders, climbed to $10.35 billion, according to Santiment data. This indicates strong interest in Ethereum’s price movement within the derivatives market, providing support for a bullish outlook for the altcoin. The increase in Ether’s price, coupled with rising futures market interest, suggests that further price gains are possible, particularly if Ethereum can successfully break through the $3,500 resistance barrier.

As Ethereum continues to face competitive pressure from Solana and other emerging blockchains, its ability to break key resistance points and sustain positive market momentum will be crucial in determining its short-term future.

Bitcoin Dominates the Crypto Space with “Digital Gold” Narrative, Leaving Ethereum Struggling with Scalability

Bitcoin (BTC) has solidified its position as the leader in the cryptocurrency market, earning the title of “digital gold.” This narrative has been widely adopted by institutional investors and traders, positioning Bitcoin as a hedge against geopolitical uncertainty and market volatility. While Bitcoin continues to thrive under this “digital gold” moniker, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, faces ongoing challenges, particularly around its scalability.

Ethereum Struggles with Scalability, Paving the Way for Layer 2 and Layer 3 Solutions

Ethereum’s scalability issues have persisted over the years, prompting the rise of Layer 2 and Layer 3 protocols designed to address network congestion and improve transaction speed. These protocols, along with their associated tokens, have yielded gains for traders in 2024. However, despite the advancements of Layer 2 and Layer 3 solutions, Ethereum’s base chain is gradually losing its appeal and market traction.

While Bitcoin’s digital gold narrative has attracted institutional interest, Ethereum is still working to deliver on its promise of being a “decentralized computer” for the world. Despite boasting a market capitalization larger than that of Bank of America as of November 22, Ethereum has failed to see significant gains in the current market cycle when compared to meme coins and other competitors, such as Solana (SOL).

Ethereum Faces Pressure as ETH/BTC Pair Declines to Near Three-Year Low

As of November 2024, Ethereum’s performance against Bitcoin has slipped to a near three-year low, as evidenced by the decline in the ETH/BTC trading pair. This downturn has been particularly pronounced since September 2023, with the pair trending downward and approaching critical support levels.

Technical indicators suggest a bearish outlook for Ethereum, with the Relative Strength Index (RSI) nearing 31—just above the oversold threshold of 30. This signals that Ethereum may be undervalued and potentially poised for a rebound, offering an opportunity for traders on the sidelines to enter the market. However, should Ethereum fail to recover from its current support levels, it could face further declines, with ETH/BTC slipping lower in the coming weeks.

Future Outlook for Ethereum: Challenges Persist Amid Competitive Pressure

As Ethereum grapples with scalability issues and stiff competition from projects like Solana and Layer 2/Layer 3 solutions, its future growth prospects remain uncertain. The market’s shift towards Bitcoin as a store of value and hedge against risk has put additional pressure on Ethereum to prove its utility and scalability. If Ethereum fails to break key resistance levels and demonstrate significant advancements in its technical roadmap, it could face further challenges in retaining investor interest and market share in the rapidly evolving cryptocurrency ecosystem.

Ethereum (ETH) Shows Positive Signs, Potential for Rally Towards $3,500 and $3,977

Ethereum (ETH) has recently displayed bullish momentum on its daily price chart against USDT, suggesting potential gains in the near future. The altcoin is currently approaching a critical resistance at $3,500, and if it sustains its upward movement, ETH could be poised for a rally toward this level and even the May 2024 peak of $3,977.

Ethereum’s Near-Term Potential: Aiming for $3,500 and Beyond

Ethereum is currently less than 5% away from the key $3,500 resistance. A rally of nearly 20% from its current price could push ETH toward the $3,977 peak seen in May 2024. Technical indicators, such as the Relative Strength Index (RSI) at 65, indicate that the altcoin is far from being overbought (which typically happens when RSI exceeds 70). This suggests that Ethereum still has room for upward movement.

Additionally, the green histogram bars on the Moving Average Convergence Divergence (MACD) indicator are supporting the positive outlook, suggesting that further gains could be in store for Ethereum. The MACD’s green bars imply that buying momentum is strengthening, which could help push Ethereum to higher price levels.

Ethereum’s Underlying Trend Remains Positive, with $4,000 in Sight

The overall trend for Ethereum is positive, as the altcoin continues its steady climb. Should ETH maintain its upward momentum, the next significant psychological level could be $4,000. Breaching the $4,000 mark would not only be a milestone for Ethereum but also signal confidence in its long-term potential and scalability improvements.

If the market sentiment remains bullish and Ethereum continues to capitalize on favorable technical indicators, it could see a break above the $3,500 resistance, with potential for a retest of the May 2024 peak at $3,977 and beyond. Traders and investors will likely keep a close eye on these levels to gauge whether Ethereum can maintain its momentum and reach new highs.

Ethereum Faces Potential Correction, Key Support Levels to Watch

Ethereum (ETH) is currently showing signs of bullish movement, but a potential correction could push the altcoin back towards significant support levels. If Ethereum faces a downturn, it may test the $3,000 support level, a critical zone that has held throughout much of 2024. A further decline could bring Ethereum closer to the lower boundary of the price range at $2,111, as highlighted on the daily price chart. Traders will need to keep an eye on these levels to determine if Ethereum can hold its ground or if further downside could occur.

Ethereum’s Strong Correlation with Bitcoin: Strategic Considerations

Ethereum’s price is highly correlated with Bitcoin (BTC), with a correlation coefficient of 0.91 according to Macroaxis.com. This means that a significant increase in Bitcoin’s price often leads to positive momentum in Ethereum as well. If Bitcoin experiences a strong rally, Ethereum is likely to benefit from the upward movement, potentially pushing its price higher.

However, Ethereum’s performance has been somewhat lagging compared to its competitors, and the altcoin is still battling resistance at the $3,500 level. A correction in Bitcoin’s price could present additional challenges for Ethereum, especially as it struggles to break through resistance and maintain its upward trend.

Traders should monitor Ethereum’s options market and open interest closely before making new positions in ETH. These metrics can provide insights into market sentiment and indicate potential price movements, helping investors assess whether the current market conditions favor an upward or downward price action for Ethereum. Properly timing entry and exit points will be crucial as Ethereum navigates both internal and external market pressures.