The cryptocurrency industry continues to evolve rapidly, with regulatory frameworks developing at a similar pace across the globe. In 2025, crypto exchanges face mounting pressure to comply with a complex array of new rules designed to ensure transparency, combat money laundering, protect consumers, and integrate digital assets into mainstream finance safely.

This article examines how major crypto exchanges are responding to these regulatory demands, the compliance upgrades they have announced, transparency initiatives, collaboration with regulators, and what these changes mean for users worldwide. Understanding this evolving regulatory landscape is essential for investors, traders, and anyone engaged in the crypto ecosystem.

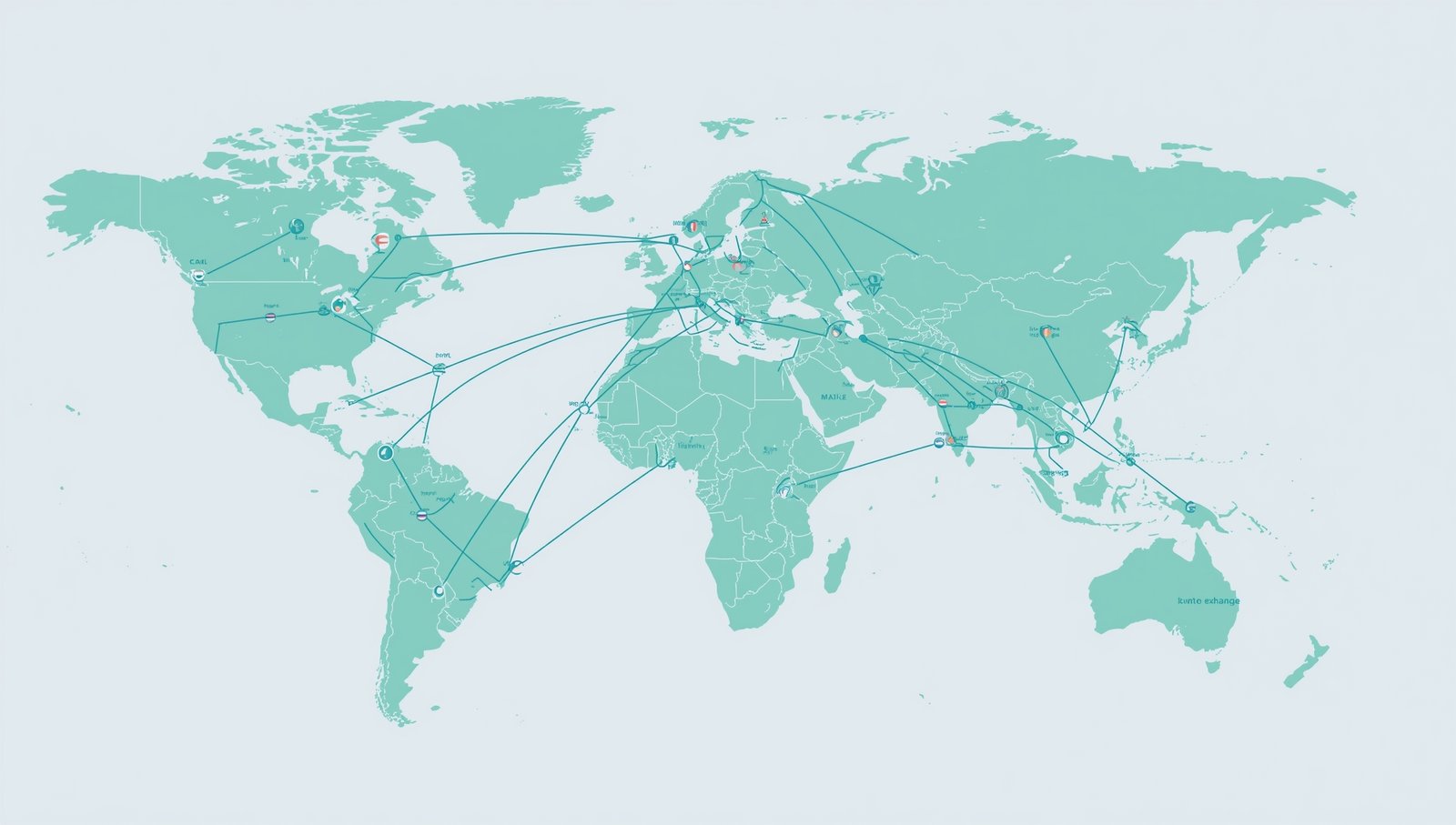

1. Overview of Global Regulatory Landscape Changes

1.1 United States

The U.S. continues to refine its approach to cryptocurrency regulation, with agencies like the SEC, CFTC, and FinCEN increasing enforcement and clarifying rules. Recent regulations emphasize Anti-Money Laundering (AML) compliance, tax reporting obligations, and consumer protections. Exchanges operating in the U.S. must now implement stricter KYC procedures and transaction monitoring.

1.2 European Union

The EU has progressed with the Markets in Crypto-Assets Regulation (MiCA), aiming to create a harmonized framework for crypto activities across member states. MiCA mandates licensing for crypto service providers, transparency in stablecoin issuance, and clear consumer rights. Exchanges are adapting their operations to meet these requirements ahead of MiCA’s enforcement.

1.3 Asia-Pacific

Countries like Singapore, Japan, South Korea, and Australia have strengthened crypto regulations focusing on licensing, AML controls, and investor safeguards. Regulatory sandboxes allow exchanges to innovate under supervised conditions, balancing growth and risk management.

1.4 Middle East and Africa

Regulatory bodies in the UAE, Saudi Arabia, and South Africa have introduced crypto frameworks aimed at fostering innovation while ensuring financial stability and security. Exchanges expanding into these regions highlight compliance with local laws as a priority.

2. Exchange Announcements on Compliance Upgrades

2.1 Enhanced KYC Verification Methods

In 2025, many exchanges have upgraded their KYC processes by adopting AI-powered identity verification tools that utilize biometric authentication, government ID verification, and real-time facial recognition. These systems accelerate onboarding while improving fraud detection.

2.2 Transaction Monitoring and Reporting Tools

Advanced blockchain analytics platforms are now integrated into exchange systems to monitor suspicious transactions continuously. Exchanges have committed to real-time reporting of illicit activity to regulatory bodies, ensuring proactive compliance.

3. Transparency Initiatives

3.1 Proof of Reserves and Regular Audits

To build trust, several top exchanges publicly share proof-of-reserves reports, verified by independent auditors, confirming that customer assets are fully backed and accessible. Regular audits and transparency reports have become standard practices.

3.2 Public Communication on Compliance Status

Exchanges actively communicate compliance updates and regulatory developments to users through blogs, newsletters, and social media, fostering a transparent relationship.

4. Collaboration with Regulators

4.1 Participation in Regulatory Sandboxes

Leading exchanges participate in regulatory sandbox programs, which allow them to test innovative products and services under regulatory oversight. This collaboration promotes safe innovation and quicker compliance adaptation.

4.2 Joint Initiatives to Fight Illicit Finance

Exchanges are partnering with government agencies and industry groups to share information and develop standards combating fraud, money laundering, and terrorist financing.

5. User Impact

5.1 Changes in Account Verification Processes

Users now experience more rigorous verification steps, including multi-factor authentication and periodic re-verification to comply with evolving standards. While these steps can add friction, they enhance overall security.

5.2 Potential Delays and Restrictions

In some regions, stricter regulations have led to temporary account holds or restrictions on certain trading activities pending compliance review, impacting user experience.

6. Future Outlook

6.1 Predictions for Regulatory Trends

Regulators worldwide are expected to continue refining crypto laws, focusing on cross-border cooperation, stablecoin regulations, and clearer definitions for decentralized finance and NFTs.

6.2 How Exchanges Plan to Innovate Within Compliance

Exchanges are investing heavily in compliance technology, user education, and partnerships to remain agile and competitive while meeting regulatory expectations.

Adapting to global regulatory changes is the defining challenge and opportunity for crypto exchanges in 2025. By upgrading compliance frameworks, embracing transparency, and collaborating with regulators, exchanges build trust and pave the way for sustainable growth in digital asset markets.

For users, these developments mean safer, more reliable platforms, though they may require adjustments in how they onboard and trade. Staying informed about regulatory shifts and exchange policies is key to navigating this dynamic environment successfully.

This content highlights the beautiful aspects of human connection and community spirit

This is exactly what I needed today 🙌 Really appreciate you posting this

Really appreciate 💖 someone who 🙏 cares enough to share valuable insights like this

Love the positive vibes in this post! Really uplifting 💪