How Bitcoin and MicroStrategy Created a Feedback Loop That Propelled MSTR Into the Top 100 Club

MicroStrategy’s Top 100 Milestone Driven by Bitcoin — How the Feedback Loop Powers Growth for Both

MicroStrategy Joins the Top 100 Club

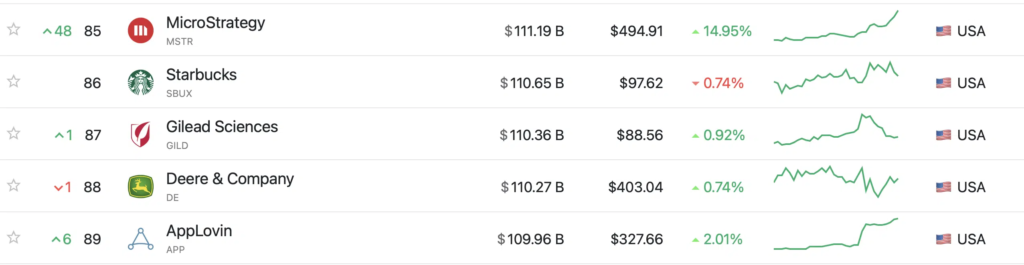

MicroStrategy (MSTR), a company closely linked to Bitcoin’s volatility, has achieved a significant milestone. As of the November 20 trading session, it soared 48 spots in just two days, securing the 85th position in the exclusive club of the top 100 publicly traded U.S. companies by market capitalization.

On November 20, MSTR’s market cap surged to nearly $111 billion, fueled by a 12% increase in its stock price on November 19, followed by an additional 15% rise. With shares now trading at $482, MicroStrategy is ending the year on a high note after an explosive period of growth.”

At the same time, Bitcoin — the cornerstone of MicroStrategy’s corporate strategy — has reached a new all-time high, surpassing $94,000 and trading at $94,850 as of November 20.

To put this in perspective, MicroStrategy’s stock has surged by 620% year-to-date in 2024, while Bitcoin has risen by over 125% during the same period.

Since adopting Bitcoin as a treasury asset in 2020, MicroStrategy’s stock has skyrocketed an incredible 2,739%, surpassing NVIDIA’s (NVDA) 2,688% gain over the same period. This transformation has positioned MicroStrategy in a league typically dominated by tech giants, banks, and energy conglomerates, reshaping the landscape for Bitcoin-heavy strategies.

This achievement places MSTR ahead of NVIDIA—currently the world’s largest publicly traded company with a market cap of over $3.6 trillion and a leader in AI and gaming innovation—when comparing performance over the last five years.

So, what does this mean for Bitcoin? Let’s dive deeper into the dynamic relationship between MicroStrategy and Bitcoin and explore how their paths intertwine, potentially rewriting financial history.

How MicroStrategy Became Bitcoin’s Biggest Backer

MicroStrategy has undergone a remarkable transformation, evolving from a business software company to the leading corporate adopter of Bitcoin. Its strategy is clear: accumulate Bitcoin as a long-term asset and use it to drive growth.

Since its first purchase in 2020, MicroStrategy has continued to expand its Bitcoin reserves through bold acquisitions and creative funding methods, tightly linking its performance to Bitcoin’s price.

As of November 20, MicroStrategy holds approximately 331,200 BTC, acquired at a total cost of $16.5 billion, averaging $49,874 per Bitcoin.

During the current bull run, the company purchased 51,780 BTC for $4.6 billion between November 11 and November 17, at an average price of $88,627 per Bitcoin.

MicroStrategy’s Bitcoin holdings, valued at over $31 billion, are more than 10 times the holdings of Marathon Digital (MARA), the second-largest public holder with around 27,000 BTC, and far surpass Tesla’s 11,500 BTC.

To fund its Bitcoin acquisitions, MicroStrategy leverages capital-raising strategies. On November 18, the company sold approximately 13.6 million shares for $4.6 billion under a pre-existing agreement.

Despite this, MicroStrategy still has $15.3 billion in shares available for future issuance, providing significant flexibility for ongoing Bitcoin investments.

And MicroStrategy is far from finished with its bold moves. Just two days ago, the company announced a $1.75 billion convertible senior note due in December 2029 with a 0% coupon rate.

Convertible senior notes are debt instruments allowing investors to lend money to a company with the option to convert that debt into shares at a later date, typically at a pre-agreed price.

In a surprising twist, MicroStrategy increased the offering to $2.6 billion, including a $400 million greenshoe option and a 55% conversion premium, citing high demand.

The greenshoe option, a common tool used to accommodate excess demand, allows underwriters to sell additional bonds beyond the initial offering. In this case, MicroStrategy’s offering includes a 55% conversion premium, meaning the bonds can be converted into shares at a price 55% higher than the company’s current stock price.

This premium reflects investor confidence in MicroStrategy’s long-term growth, even as its stock continues to rise, signaling a strong belief in the company’s Bitcoin-driven strategy. Essentially, investors are betting on the company’s future success, closely tied to its growing Bitcoin reserves.

A Vision Beyond Bitcoin Holdings

MicroStrategy’s journey is far from over, and the company’s next steps are shaping up to be even more ambitious.

Under the leadership of Executive Chairman Michael Saylor, MicroStrategy is not only making Bitcoin a cornerstone of its own strategy but also working to bring Bitcoin adoption to the broader corporate world.

On November 19, Saylor announced during an X Spaces event hosted by VanEck that he would be delivering a three-minute presentation to Microsoft’s board of directors to advocate for the integration of Bitcoin into their investment strategy.

Saylor has openly expressed his belief that Bitcoin should be on the agenda for every major corporation, from Apple and Meta to Berkshire Hathaway.

He argues that holding Bitcoin as a tangible asset could provide stability for companies’ stock values, especially when compared to the volatility of quarterly earnings reports. For example, Microsoft’s current enterprise value is primarily based on 98.5% of its earnings, with only a small portion backed by tangible assets. Saylor suggests that Bitcoin could offer a more balanced approach, potentially preserving shareholder value over the long term.

Beyond Influencing Others: MicroStrategy Doubles Down

MicroStrategy is not only advocating for Bitcoin adoption but also doubling down on its own Bitcoin strategy with an ambitious initiative known as the “21/21 Plan.”

Launched in late October, this plan aims to raise $42 billion over the next three years—$21 billion through equity and another $21 billion through debt. The goal is to acquire more Bitcoin and cement its position as the world’s leading Bitcoin treasury company.

CEO Phong Le stated that the capital raised will allow MicroStrategy to deploy its Bitcoin more strategically, enhancing returns while maintaining a robust reserve.

The Bitcoin-MSTR Feedback Loop

MicroStrategy’s approach has created an intriguing—though controversial—feedback loop that directly links its performance to Bitcoin’s price movements, amplifying both assets in the process.

The more Bitcoin MicroStrategy acquires, the more the circulating supply shrinks, driving up Bitcoin’s price, particularly during bullish markets. As the value of its Bitcoin holdings rises, so does MicroStrategy’s stock price, which in turn attracts more investors and further increases its value.

A higher stock price enables MicroStrategy to raise additional capital through share sales or debt offerings, which is then used to buy even more Bitcoin.

It’s a cycle that feeds itself and has proven highly effective so far. However, it also raises important questions about its long-term sustainability.

Critics, including Bitcoin skeptic Peter Schiff, are raising concerns about whether this self-reinforcing cycle could eventually lead to an unsustainable bubble.

But what makes this feedback loop particularly unique—and potentially risky—is the sheer scale of MicroStrategy’s Bitcoin holdings.

The company now controls over 1% of Bitcoin’s total supply, a staggering figure that gives it significant influence over the market. Each major acquisition further tightens the available Bitcoin supply, potentially driving up its price due to increased demand.

If MicroStrategy’s strategy proves successful, it could set a precedent, encouraging other companies to follow suit and further amplifying this cycle. However, if Bitcoin’s price experiences a downturn, the entire mechanism could unravel, leading to losses for both the stock and Bitcoin.

This also raises an important point: Bitcoin’s price is becoming increasingly tethered to the actions of large institutional players like MicroStrategy. This shift marks a departure from Bitcoin’s early days as a decentralized asset, with less influence from centralized entities.

The critical question is whether this symbiotic relationship between MicroStrategy and Bitcoin can remain sustainable in the long term—or if it’s a fragile structure that relies too heavily on constant upward momentum.

Good article. I certainly love this site. Continue the good work!